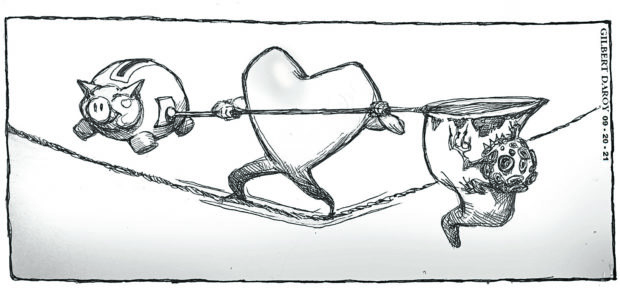

Balancing act for Pag-IBIG

Last Sept. 9, the Philippine Chamber of Commerce and Industry, the Employers Confederation of the Philippines (Ecop), and the Philippine Exporters Confederation Inc. (Philexport) took up the cudgels for business establishments ravaged by the economic impact of the COVID-19 pandemic. They asked the Home Development Mutual Fund (more known as the Pag-IBIG Fund) to condone the penalties for the companies’ failure to remit their employees’ savings in the past two years to the government agency, a duty mandated by law.

In a joint letter addressed to Pag-IBIG chief executive Acmad Moti, the groups said more than 35,000 establishments across the country had filed for permanent closure since last year, displacing 710,417 workers.

Article continues after this advertisement“In line with this, we are requesting from your good office to extend help in easing the burden of Filipino business owners who were affected by the pandemic by offering a penalty condonation program for businesses who failed to remit their employees’ savings,” said the Sept. 9 letter, which went public last week. The groups requested that these business owners applying for penalty condonation also be given a longer payment plan to settle all their outstanding obligations with the Pag-IBIG Fund.

The sentiment is understandable, and struggling businesses do deserve help from the government. But there is a complication left unmentioned in the business groups’ appeal: If the Pag-IBIG Fund agrees to condone the companies’ delay or failure to remit employees’ savings, how might that impact the employees’ standing under the fund? Ordinary workers may end up being declared delinquent members for tardy or missing payments not of their own doing, and so would be ineligible to avail themselves of the financial services offered by Pag-IBIG.

That worrying possibility comes when the need of many households for emergency funding is never more evident than during this pandemic. More and more Filipinos are being forced to draw loans against their future salaries to finance emergency medical care, education, household bills, and other personal expenses. A research paper issued last week by Singapore-based fintech group UnaFinancial showed that each household in the Philippines spends about P596,300 a year or about P49,700 a month. But, citing data on wages for 2021, it said half of the employees in the country receive less than P48,200 a month. Thus, per UnaFinancial’s estimate, about 22.7 million Filipinos would potentially be salary loan borrowers, including those working in private and public enterprises as well as self-employed people working informally or temporarily. In the event of an emergency or loss of a job, these are the people who may need to borrow to cover their expenses.

Article continues after this advertisementThe Pag-IBIG Fund provides a Multi-Purpose Loan that extends cash to members in need of immediate financial assistance. A member can borrow up to 80 percent of his/her Pag-IBIG Regular Savings, and the loan is processed in as fast as two days. There is also the Pag-IBIG Fund Calamity Loan, another cash loan facility to assist members living in areas declared under a state of calamity and are affected by such disasters. The loan carries a low interest rate of 5.95 percent a year and is payable over 36 or 24 months, with a deferred first payment.

Should Pag-IBIG decide to temporarily relax regulations on the timely remittances of employee contributions by companies, it needs to make a parallel rule assuring the welfare of workers—that the delayed remittances will not in any way be taken against the employees’ ability to access Pag-IBIG services. It has the resources to do this balancing act. The fund posted a net income of P16.11 billion in the first half of 2021 despite the lingering health crisis. This was up by 14 percent from the same period last year. As of July, the Pag-IBIG Fund has released P52.22 billion to finance the acquisition of 51,206 homes for its members. During the same period, the agency granted P25.42 billion in cash loans, helping more than 1.18 million members cover their immediate financial needs as the health crisis continued. Savings from its members also reached P37.46 billion as of July.

In 1986, Florencio B. Orendain, the founding chief executive of the fund, said in his farewell letter to the members: “Pag-IBIG Fund is a long-term savings system established to provide for the future of the members and their beneficiaries. It is a national provident system owned by the workers—a purely private fund with the government serving as both trustee and guarantor. Pag-IBIG’s commitment to serve you—its members shall live on. After all, you are the fund’s owners and masters. The fund exists to serve you.”

Orendain’s reminder is clear—that Pag-IBIG should remain “true to its commitment to be ‘of the workers’ and ‘for the workers’.”