From hard-hit to hopeful

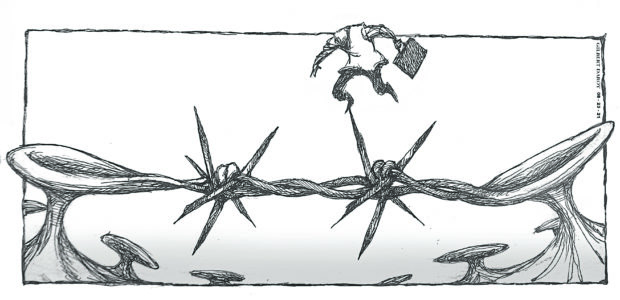

The prolonged pandemic has forced many Filipinos out of work, or to accept lower pay, as scores of companies struggle with plummeting sales, recurring lockdowns, and the need to survive the extended economic recession.

It’s a bleak scenario, but some people are finding ways to evolve — by trying out some form of entrepreneurship or other to support their households, and this is occurring even among those who have been lucky enough to keep their day jobs.

A survey conducted by financial literacy advocacy group The Global Filipino Investors (TGFI) among more than a thousand respondents, most of them based in the country, showed that 64 percent of employed people tried to launch a new business while staying in their current jobs during the pandemic. Close to half went into online selling, while 14 percent tapped opportunities in freelancing. TGFI expects these numbers to still go up, as 18 percent of the respondents said they had lost their main sources of income with the onset of the health crisis.

However, many of them are also finding out that venturing into a new money-making activity is fraught with obstacles. Aside from the need to be technologically adept, new entrepreneurs have to familiarize themselves and comply with a blizzard of government regulations, mainly on business registration, product registration, and taxation.

The TGFI survey showed that education—knowing which business to venture into and the financial literacy one needs to succeed—is still a major challenge for those just starting out to build their own business. TGFI founder and president Floi Wycoco, a former overseas Filipino worker, noted that before the pandemic, aspiring entrepreneurs could easily meet up with friends or attend government-sponsored events to pick up new money-making ideas. But the lockdowns have ruled out such face-to-face gatherings. Building one’s network, which is needed to succeed in selling, was much better when aspiring entrepreneurs could meet in person, according to Wycoco.

Another major challenge is adapting one’s systems to a digital marketplace. “A lot of respondents are still slowly shifting or familiarizing themselves with the use of payment platforms online. Other than having their products available not just on social media platforms, building their own websites is also a bit of a challenge,” said Wycoco.

While financial technology—mainly the use of online bank payment schemes or e-wallets that allow money transactions by customers through their mobile phones or laptops—has accelerated and expanded in the country in the wake of the mobility restraints imposed by the pandemic, it has also been difficult for many ordinary people to understand and embrace. The problem is worse for minimum wage earners: The cost of internet needed for an active online presence even on free social media sites is quite prohibitive.

Getting a grasp of financial technology appears to be just as daunting for prospective buyers or customers: The TGFI survey found that while the use of online banking has jumped by 75 percent and e-wallets by 71 percent as preferred payment modes, 42 percent of the respondents still chose cash as their payment mode, and only 2 percent have been using credit cards to pay for their transactions.

Government regulation and compliance, of course, remain the biggest worry for new entrepreneurs, such as getting a notice from the Bureau of Internal Revenue for everyone doing business using the internet to register by a set date and begin paying taxes. Registration and taxation laws must be implemented, and there are, to be fair, government benefits from adhering to such regulations. Registered businesses, for instance, “are entitled to the Department of Trade and Industry’s low-interest loan program and may qualify for the government’s small business wage subsidy programs,” as a previous editorial in this paper pointed out. But there is no reason the government can’t make the process less painful and arduous for harried citizens just learning the ropes of launching and sustaining a business. Registration requirements, for instance, should be designed so as not to burden small-time sellers and resellers with additional financial costs and other bureaucratic encumbrances.

While the TGFI survey showed that the pandemic has been, for some Filipinos, a gritty learning experience that has compelled them to become more resourceful, creative, and enterprising in generating new income, what the survey also underlined is how these struggling entrepreneurs still need all the help they can get—mainly from the government via minimum regulation and red tape, and from big business via the reduced cost of learning, adopting, and earning from technology, as they now transition from workers and employees hit hard by the health and economic crises to hopeful entrepreneurs under the new normal.