Breaking down the tax reform package

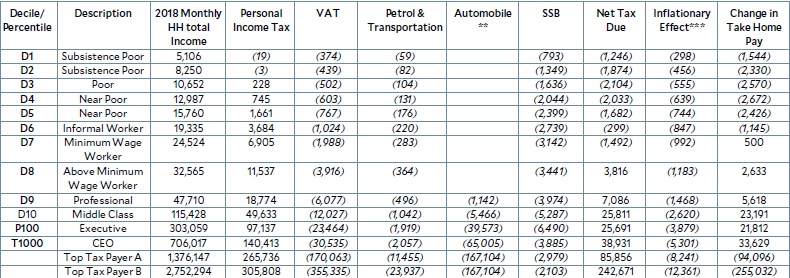

This table, from the Department of Finance, shows its estimates of the combined impact of the “TARA sa TRAIN” (Tax Administration Reform Act, Tax Reform for Acceleration and Inclusion) on Filipino households (hh).

The first column breaks down the households by decile (definition: each of 10 equal groups into which a population can be divided according to the distribution of values of a particular variable, which in this case is household income). Thus, you have the column listing from D1 to D10. The highest income decile (D10) is further broken down into the top 1 percent (P100), and even further into the top 0.1 percent (P1,000). This further subdivision is done so we can see what the tax reform does to this elite class.

The second column describes the characteristics of each of the deciles. Note that the bottom 50 percent of income earners are either “Subsistence Poor,” “Poor” or “Near Poor.” Note that the “Minimum Wage Worker” comes in the seventh decile, and the highest (tenth) income decile is only where the “Middle Class” begins.

Article continues after this advertisementThat decile is further broken down into “Executive,” those who belong to the top 1 percent, and still further into the top one-tenth of one percent are labeled “CEO.”

Now we come to the third column, which shows the 2018 monthly hh total income by decile. The DOF assumes that each hh has two income earners. The next seven columns give the impact of each of the tax measures in the tax reform package plus the effect of inflation.

The last column summarizes the final impact: the resulting change in take-home pay. Visually, without even looking at the details, the reader can see that the bottom 60 percent of income earners are negatively impacted by the package (the figures are in italics, and are parenthesized) as well as the top 0.1 percent. Those are the DOF estimates.

Article continues after this advertisementTo make up for the minuses, there is a complicated and not yet worked out system of transfers that add up to P3,000 a year for the first five deciles and P1,500 for the next two (up to the seventh decile). BUT: This is relief that lasts only four years. WHY ONLY FOUR YEARS? No one who has critiqued my stand has answered.

Source: DOF staff estimates using the preliminary Family Income and Expenditure Survey- Labor Force Survey 2015

Notes: Each household has about two income earners

*Total household income includes compensation income, income from entrepreneurial activities (i.e. businesses) and other sources of income (i.e. cash transfers)

**Automobile excise tax impact was computed using 2016 prices, assuming 5 years of amortization

***The inflationary effect was computed as a function of income, marginal propensity to consume (MPC), and estimates on the price effect of the increased oil excise on the price of food