The BIR says that the additional information is meant to help it validate final income taxes and catch tax cheats who fail to remit withholding taxes. It claims that disclosing one’s interest income from banks does not violate the bank secrecy law.

But a number of business and professional groups counter that the new requirements violate the secrecy law. Besides being an additional burden on taxpayers, the requirements do not ensure increased tax collection, according to a group of accountants.)

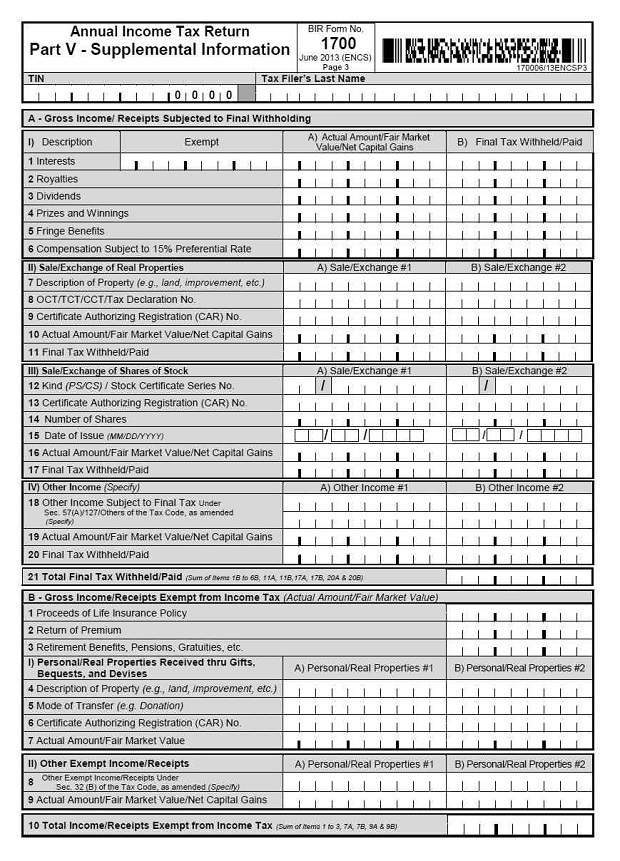

Supplemental information a must

The new Bureau of Internal Revenue (BIR) Annual Income Tax Returns (BIR Forms 1700, 1701, 1702-RT, 1702-MX and 1702-EX) require taxpayers to disclose supplemental information on their other incomes.

However, under the BIR’s Revenue Memorandum Circular No. 9-2014, which took effect last Feb. 11, the requirement is optional for individual taxpayers but mandatory for corporate or non-individual taxpayers for income tax filing covering calendar year 2013, which is due this coming April 15.

It will be mandatory for individual taxpayers for income tax filing starting calendar year 2014.

Supplemental information on their other income include income subjected to final tax, such as the following:

Interests

Royalties

Dividends

Prizes and winnings

Fringe benefits

Capital gains from the sale of stocks not traded in the stock exchange and from the sale of real properties

It also requires the disclosure of items excluded from gross income under Section 32(B) of the Tax Code, such as the following:

Proceeds of life insurance policy

Return of premium

Retirement benefits

Pensions

Gratuities

Property received through donation and inheritance

Stock transactions done through the Philippine Stock Exchange

All taxpayers

All taxpayers, whether they are individuals earning purely compensation or salary income or self-employed individuals, estates, trusts are required to disclose such supplemental information.

Fine, imprisonment

Those who fail to comply may be criminally charged for violation of Section 255 of the Tax Code or failure to supply correct and accurate information in their tax returns, which is punishable by a fine of at least P10,000 and imprisonment of one year to 10 years.

The disclosure requirement is expected to help the BIR to confirm and validate final taxes being withheld by the payors and catch tax cheats who fail to remit withholding taxes.

Net worth

It will also help the agency in establishing an information cache that will make it easier to verify a taxpayer’s net worth on the basis not only of his active but also of his passive income from investments and the like.

In fact, it will be to the advantage of those who are wary of arbitrary or unfair audits by the BIR since the supplemental disclosure will grant them an avenue, on the record no less, to explain their ownership of assets, which could not otherwise be supported by their active income alone.

Secrecy laws not violated

While there are much-publicized apprehensions, it should be clarified that one’s disclosure of interest income from banks does not run counter to our bank secrecy laws.

What these laws prohibit is the unauthorized disclosure by the banks of the account information of their depositors. The BIR, as the country’s tax authority, is in no way prohibited from requiring taxpayers to report their interest income.

It is also subsumed in the Commissioner of Internal Revenue’s authority under the Tax Code to prescribe additional procedural and documentary requirements for tax administration and enforcement.

Moreover, the secrecy and integrity of the taxpayers’ supplemental information, along with the rest of their tax returns and transactions with the BIR, are amply protected by law.

Section 270 of the Tax Code strictly prohibits all officers and employees of the BIR from divulging or leaking, in any manner, any information—including those on details and amounts of income in the tax returns.

Conviction under this section entails a fine of P50,000 to P100,000 or imprisonment of two years to five years, or both.

(Kim Henares is the Bureau of Internal Revenue commissioner; Marissa Cabreros is an assistant commissioner; and, Abigail Gamboa is the chief of staff of the deputy commissioner for the legal group.)