Married to the public

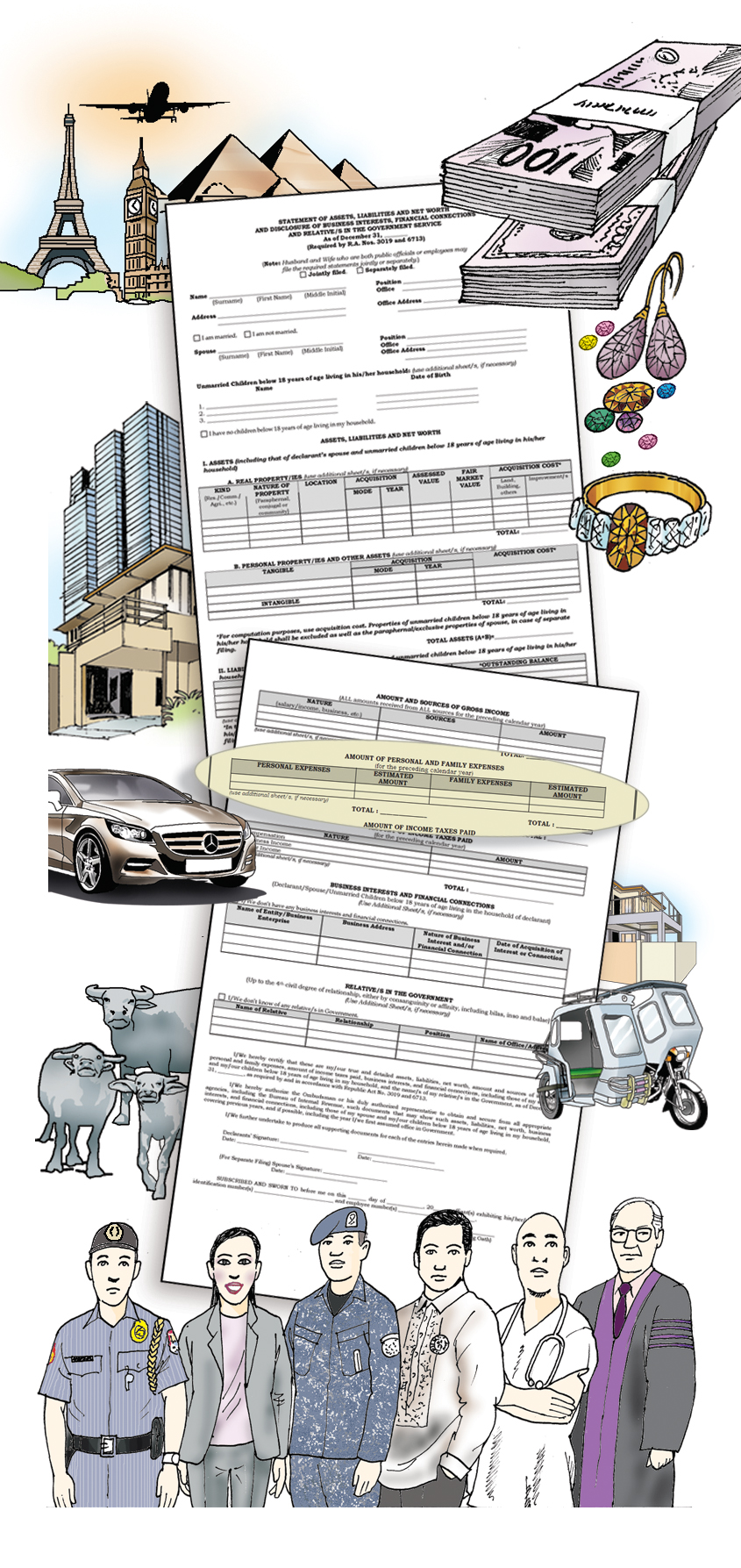

THE NEW SALN form requires civil servants to declare their personal and family expenses. Illustration by Ernie Sambo

The statement of assets, liabilities and net worth (SALN), which all public officials and employees are mandated to file, [is] the means to achieve the policy of accountability of all public officers and employees in the government. By the SALN, the public [is] able to monitor movement in the fortune of a public official; it is a valid check and balance mechanism to verify undisclosed properties and wealth.” (Liberato M. Carabeo v. Court of Appeals et al., GR Nos. 178000 and 178003 dated Dec. 4, 2009)

Thus did the Supreme Court describe the SALN, a document which government employees treat as just one of those forms which they have to fill out every year and which, of late, has stirred the nation’s interest as a result of the impeachment trial of Chief Justice Renato Corona.

Article continues after this advertisementLegal basis

The SALN was originally required by the Anti-Graft and Corrupt Practices Act of the Philippines (Republic Act No. 3019, as amended) enacted on Aug. 17, 1960. This was reinforced by the Revised Administrative Code of 1987, the 1987 Constitution and the Code of Conduct and Ethical Standards for Public Officials and Employees (Republic Act No. 6713).

RA 6713 and its implementing rules and regulations require that all public officials (elective and appointive) and employees —except those who serve in an honorary capacity, laborers and casual or temporary workers—file under oath their SALNs and disclosure of business interests and financial connections and those of their spouses and unmarried children below 18 living in their households. Officials and employees with temporary status are also required to file their SALNs.

Article continues after this advertisementIntangible property

The listing of assets includes those within and outside of the Philippines, whether real or personal, tangible (can be touched like real and personal property) or intangible (property that is a representative or evidence of value like stocks, bonds, certificates, promissory notes, copyrights and franchises), and whether or not used in trade or business.

Real properties shall be described by their kind (residential, commercial or agricultural), nature (paraphernal, conjugal or community), exact location, with their values (assessed, current fair market and acquisition cost), and improvements on the land or buildings. Personal properties, with acquisition costs, include jewelry, appliances, furniture and motor vehicles.

Liabilities refer to loans obtained by the official or employee, his or her spouse and unmarried children below 18 living in the household of the official or employee, from banks, financial institutions, the Government Service Insurance System, Pag-Ibig and the like. (See definition of terms below.)

In addition, RA 3019 mandates that the SALN include “a statement of the amounts and sources of his income, the amounts of his personal and family expenses and the amount of income taxes paid for the preceding calendar year.”

Taxes, household bills

Thus, the revised SALN form requires a listing of other sources of income (derived from the practice of a profession or business) and income taxes paid the previous year, and expenses for household bills (telephone, cable TV, electricity and water), groceries, children’s tuition, travel and entertainment.

The expenses need not be itemized but be only a general statement for the year and its corresponding amount.

Lifestyle check

The objective of the requirement is to check the lifestyle of the government employee and his or her family in relation to his or her income. This will effectively help the government monitor the lifestyle of any government official or employee if it is manifestly out of proportion to his or her salary and other lawful income.

The objective simply implements one of the required norms of conduct of public officials and employees in RA 6713 that “public officials and employees and their families shall lead modest lives appropriate to their positions and income. They shall not indulge in extravagant or ostentatious display of wealth in any form.”

By April 30

As required by RA 6713, the SALN must be filed within 30 days after assumption of office, on or before April 30 of every year thereafter and within 30 days after separation from the service.

In addition to the listing of assets and liabilities, personal and family expenses, and income taxes paid, all public officials and employees required to file the SALN shall also execute the necessary authority in favor of the Ombudsman to obtain from all appropriate government agencies, including the Bureau of Internal Revenue, such documents that may show their assets, liabilities, net worth, business interests and financial connections in previous years.

‘Bilas,’ review committee

An additional requirement in the SALN is the identification by every public official and employee of his or her relatives in government up to the fourth civil degree of relationship, either of consanguinity or affinity, including bilas, inso and balae.

To determine whether the SALNs are submitted on time, are complete and are in proper form, RA 6713 requires the creation of a review and compliance committee in every agency composed of three members. Should the committee find that the SALN is not properly filed, it shall inform the official or employee and direct him or her to take the necessary corrective action.

Fine, imprisonment

Depending on the gravity of the offense in the non-filing of the SALN or misrepresentations in the form, any official or employee shall be punished with a fine equivalent to not more than six months’ salary or suspension not exceeding one year, or removal from the service.

Violations in the SALN filing is also punishable with imprisonment not exceeding five years or a fine not exceeding P5,000 or both at the discretion of a judicial court.

Role of CSC

RA 6713 gives the Civil Service Commission (CSC) the primary responsibility for the administration and enforcement of the law, including the promulgation of rules and regulations.

Pursuant to this mandate, the CSC formulated the SALN form which it revised in 2011 with the assistance of a technical working group composed of representatives of the commission, Office of the Ombudsman, Commission on Audit, Sandiganbayan, Office of the President, Department of Justice and House of Representatives.

Recent newspaper reports indicate that certain quarters are opposed to the revised SALN form prescribed by the CSC in Memorandum Circular No. 19, dated Aug. 17, 2011. They claim that the revised form is unconstitutional as it includes items not found in existing law.

It is the stand of the Civil Service Commission that any questions on the validity or constitutionality of the SALN form is a question of law. Unless declared unconstitutional by the Supreme Court, the revised SALN form is considered valid and in accordance with the requirements of RA 3019 and RA 6713.

(Ariel G. Ronquillo is a director of the Civil Service Commission’s Office for Legal Affairs.)