Reforming the MUP pension system

For our military and uniformed personnel (MUPs)—which include soldiers, police, firefighters, and prison staff—plans of changing their pension system may feel like a discredit to their service and sacrifices for the country.

Most of the current benefits enjoyed by MUPs were instituted 75 years ago.

In 1948, or three years after World War II, Republic Act No. 340 helped ensure a comfortable retirement for MUPs. The law granted automatic promotion upon retirement and a monthly pension “indexed” or equivalent to the base pay of active personnel with the same rank. The law also made it the government’s full responsibility to fully fund the pension of MUPs. Unlike private employees and civilian government workers who contribute monthly to the Social Security System and Government Service Insurance System, respectively, soldiers and other uniformed personnel don’t have salary deductions that go to their pension system.

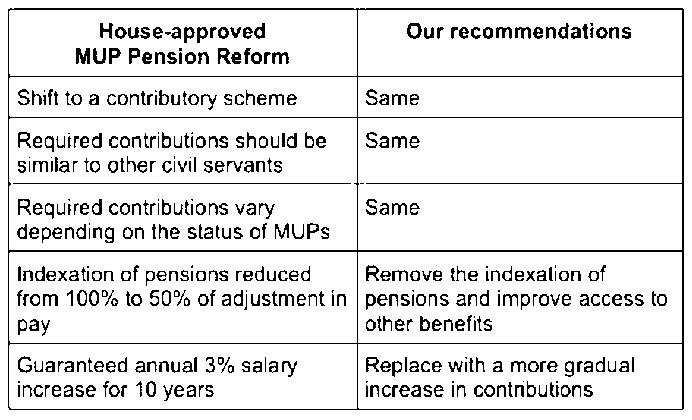

Article continues after this advertisementFast forward to 2023: The budget needed to fund the pension of MUPs is now larger than the budget required to fund the day-to-day activities of active personnel. Budget spent on the pension of MUPs has doubled in 10 years, from P64.2 billion in 2013 to P128.6 billion in 2023. Since the base salaries of active MUPs were doubled in 2018, the monthly pension of retirees also doubled. However, the same cannot be said about our national budget. To ensure that current and future MUP retirees will have a sustainable source of pensions, President Marcos made it his administration’s priority to reform the current MUP pension system. A bill on this was recently passed in the House, with our points of agreement outlined below:

First, MUPs should contribute to fund their pensions. Among the Asean-5, the Philippines is the only country that has a noncontribution scheme, unlike Indonesia, Malaysia, Thailand, and Singapore where MUPs contribute a portion of their salary, which the national government supplements. Second, the MUPs’ automatic salary deduction for their pension should be similar to those of other civil servants: 9 percent, while the government contributes 12 percent. This would incentivize Filipinos to choose a public service track that suits them best.

Article continues after this advertisementThird, required contributions should vary depending on the status of MUPs, with new recruits contributing 9 percent, while those in active service should start contributing a smaller portion that increases annually, until it reaches 9 percent. Those already retired are no longer expected to contribute, while it may be a good compromise to do the same for MUPs nearing retirement, or have served for at least 30 years.

Meanwhile, we urge lawmakers to consider the following modifications given the current fiscal implications of the bill: First, remove the indexation of pension payments to the base pay of active personnel, since (a) it is not a usual practice for developing countries given their limited fiscal space; (b) the MUP trust fund may be doomed to fail like the Armed Forces Retirement and Separation Benefits System which was shut down in 2006; and (c) there are other ways to ensure that MUPs can retire comfortably, like expanding access to health care and housing benefits.

Second, implement a more gradual annual increase in the required deductions for active personnel. In the current bill, active MUPs will contribute 5 percent for the first three years, 7 percent for the next three years, and 9 percent thereafter. To make it easier for MUPs to transition to the new system, the proposed reform guarantees a 3 percent annual salary increase for active personnel in the next 10 years. The current proposal could further sink our country into debt since pension indexation means that more budget will again be needed to fund current pensions. More importantly, this system means that public funds will be used to fully subsidize the pension contributions of active MUPs by its second year of implementation. A better way would be to start with a smaller deduction (1 to 2 percent) in the first year of implementation, with a smaller annual increase of 1 percent to help MUPs and their families adjust their household budget more easily.

There is no doubt that the MUP pension reform is necessary to ensure both our country’s fiscal health and the welfare of MUPs in the long run. Retaining pension indexation and providing annual salary hikes means a bigger budget for the MUP sector in the coming years. Accordingly, we urge our policymakers to revisit the short-run fiscal implications of the current proposed MUP pension reform, as our country is still recovering from the pandemic and reeling from other problems like high inflation and poverty.

—————-

Gary B. Teves served as finance secretary under the Arroyo administration.