Passing the debt burden

Finance Secretary Carlos G. Dominguez III has not come out and said it outright, but he has dropped enough hints for observers to conclude that the incoming administration may have no choice but to impose new or higher taxes to pay the massive foreign debts that the Duterte administration has incurred because of the COVID-19 pandemic.

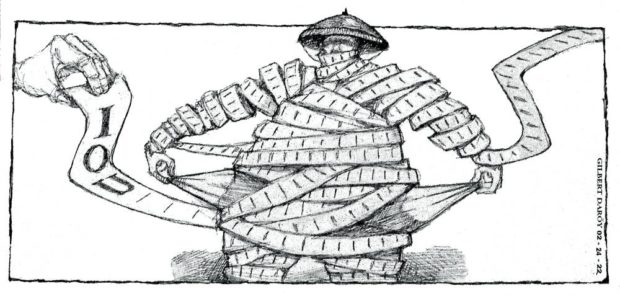

With just a few months left in office, Dominguez said the Duterte administration was preparing a “fiscal consolidation package” to be discussed with those vying to be the next president, outlining proposed measures on how to handle the country’s outstanding debt burden that skyrocketed last year to a knee-buckling P11.73 trillion, heavier by a fifth from the 2020 level.

Dominguez has been mum about the fine print of the working package, but said it “contains a combination of improvements to tax administration to plug existing leakages and updated tax policy proposals that build on our past reforms.”

It was also proposed that the next administration should focus on “relatively untaxed” sectors such as cryptocurrencies alongside further increasing excise taxes on cigarettes, alcoholic drinks, and sugary beverages and even lifting all exemptions to the 12-percent value-added tax.

Dominguez had repeatedly said that easing the country’s debt burden should be a top priority of the next president, to ensure the country’s continuing recovery from the twin public health and economic crises spawned by the two-year-old COVID-19 pandemic.

“The government has accommodated the huge cost of COVID-19 crisis response to help vulnerable sectors survive and recover from the crisis … But we are also mindful not to pass on to future generations unsustainable debt,” Dominguez said.

The government dramatically hiked foreign borrowings to cover the huge cost of its COVID-19 response program, surging to $25.7 billion as of mid-January.

This includes the $2 billion used to acquire COVID-19 vaccines to accelerate its mass vaccination program, which will pave the way for the reopening of more productive economic sectors and put the Philippines back on its high growth path after suffering from its worst post-war recession in 2020 at the height of the pandemic.

The outsized borrowings, however, pushed the closely watched public debt-to-gross domestic product ratio—or the size of the country’s debt relative to its economic output—to a 16-year high of 60.5 percent in 2021, exceeding the 60 percent level that debt watchers consider manageable for emerging markets and far off the historic low of 39.6 percent in 2019.

Staying too long beyond the 60-percent threshold puts the country at risk of losing its coveted investment-grade rating. A dreaded downgrade will make it more expensive for the Philippines to borrow abroad as it will be deemed a riskier bet.

Fortunately, Fitch Ratings has retained its BBB rating—a notch above minimum investment grade—for the Philippines, citing the hard-fought economic gains alongside the sustained recovery from the protracted pandemic.

But at the same time, it kept its “negative” outlook, which means that a downgrade is possible due to risks that include the fiscal cost of the government’s COVID-19 response along with uncertainties over policies given the coming presidential elections.

Dominguez, however, has assured an anxious public that the “spike” in the debt-to-GDP ratio was “well-within affordability.”

But with government revenues still depressed as individual and corporate taxpayers are still shaking off the lingering effects of the pandemic and the consequent lockdowns that stifled economic activity, it seems inevitable that tax measures will have to be imposed to service the debts.

Clearly, reducing the debt burden is a challenging task that will require a well-calibrated response from the country’s next chief executive, who will have to bring to the table more than just rhetoric or platitudes to “unity.”

The next president, indeed, should have the wherewithal to balance competing interests and proposals on how to quickly reduce the debt burden and take into consideration the pressing need to continue lending support to those still reeling from the impact of the COVID-19 pandemic and other challenges such as the continuing hike in the prices of basic commodities as global oil prices surge.

But the outgoing administration, more than just passing the debt burden to the next government, should account for the enormous debts incurred in the name of the COVID-19 pandemic response. The next administration must clearly see whether the billions of dollars borrowed were spent for their intended purpose, and not lost to corruption, so that the Philippines would be able to “outgrow” the debts. Only then will the prospect of new or increased taxes — if indeed inevitable — will start becoming acceptable.