Bitter pill for sugar industry

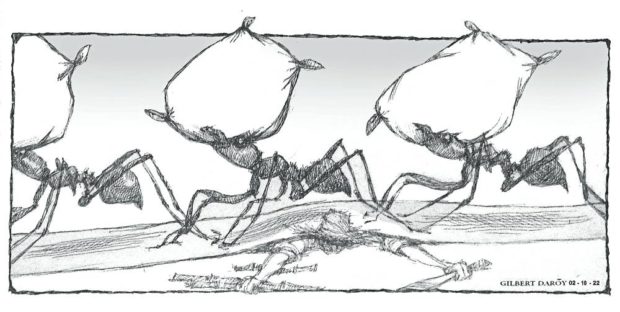

Last week, the Sugar Regulatory Administration issued an order allowing the entry to the Philippines of 200,000 metric tons of refined sugar, a controversial move that sugar planters have described as “appalling” and “very ill-timed” considering that the shipments will start arriving at the peak of the sugar milling season.

“The very agency that is supposed to protect us seems determined to kill the industry,” lamented Manuel Lamata, president of the United Sugar Producers Federation (Unifed), one of the country’s largest federations of sugar planters.

Article continues after this advertisementThe SRA, however, justified the importation by citing the shortfall in local sugar output following the devastation wrought by Supertyphoon “Odette” late last year on sugar-producing provinces and the urgent need to rein in market prices that have surged to record highs.

SRA data showed that as of last Jan. 23, the wholesale price of refined sugar in the National Capital Region has climbed to P2,900 per 50-kilogram bag from P2,150 in the same period last year. This translated to a 14-percent increase in the retail price of the prime commodity to P57 a kilogram from P50 last year.

And with the SRA projecting “a very tight” sugar supply that “will not be enough” to cover the rapidly increasing demand for sugar in the two to three months between milling seasons, the pressure is there for sugar prices to further rise.

Article continues after this advertisementAccording to the SRA’s revised figures, raw sugar production for crop year 2021-2022 ending August will hit 2.072 million metric tons, down from the initial estimate of 2.099 metric tons prior to Odette, which caused some P1.15 billion in damage to sugarcane crops, sugar stocks at warehouses and facilities and equipment of sugar mills and refineries in key sugar milling districts.

The Philippine Association of Sugar Refineries also trimmed its refined sugar production forecast for crop year 2021-2022 to 16.748 million 50-kilogram bags, down from the earlier output estimate of 17.572 million 50-kilogram bags before Odette — the strongest typhoon to hit the country in 2021 — lashed central and southern Philippines in December.

“As the economy is once again starting to open up, the demand for raw sugar and refined sugar for January this year have also increased when compared to the same month in the three previous years,” said SRA Administrator Hermenegildo Serafica, “Hence the need to augment sugar stocks to ensure food security and availability of sugar to cover sugar demand until the next crop year or milling season begins again.”

While Unifed acknowledged the projection from industry stakeholders that there will be a shortage of sugar due to low production in sugar lands, especially in the Negros region that accounts for more than half of the country’s total output, former SRA board member Dino Yulo said the volume was “way too much.”

Then there’s the question of who stands to really benefit from the sugar importation program.

For Yulo, it is not the small vendors who will gain from the added sugar but rather the large-scale industrial users, including manufacturers of biscuits, breads, candies and confectioneries, and beverages, that have been provided half of the import quota.

“We are still in a midst of a crisis, and our sugar planters in Southern Negros are still trying to recover from the effects of Odette, and here is another crisis that will hit us,” said Yulo.

Lamata also roundly countered the SRA’s argument on rising prices, saying that the SRA has been blind to the real forces driving up retail and wholesale prices.

The desire to earn a handsome profit is not one of them. On the contrary, Lamata said the margins were merely covering the escalating cost of production.

“They only see the increasing cost of sugar in the market but they do not acknowledge the forces driving those prices up, and much of it can be attributed to fertilizers that almost tripled its cost and fuel that has breached the P50 per liter mark,” Lamata said.

“Whatever increase in sugar prices we are seeing in the market goes to our paying high cost of farm inputs,” added Lamata, who said the group had requested as early as last year the Departments of Trade and Industry and Agriculture to cap the cost of fertilizers, a key input in sugar production.

Given these, there are clearly more factors that the SRA should consider aside from sugar output levels and market prices as it pursues its importation program.

It would indeed better serve its mandate to the people by heeding the call of the sugar planters to “get a good picture from the ground” so that the program will yield its intended outcomes and not become another bitter pill for the battered local sugar industry to swallow.

RELATED STORIES