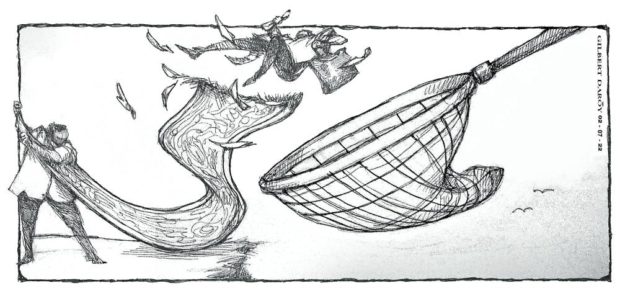

Protecting small investors

The local financial community was stunned last week by the unexpected decision of Dito CME Holdings Corp., the parent firm of the third telco player owned by Davao-based businessman Dennis A. Uy, to abort its P8-billion stock rights offering that had been ongoing for about a month. The deal was pulled out due to weak demand from institutional investors and “other perceived risks,” and came just months before President Duterte — who considers Uy a friend aside from being a prominent campaign donor — leaves Malacañang.

Philippine Stock Exchange (PSE) president Ramon S. Monzon was among those who immediately demanded an explanation from Dito CME. Last Jan. 13, Dito CME had sought a one-week extension of the offer deadline to Jan. 25, claiming it needed more time because of the recent COVID-19 surge.

On Jan. 29, however, the PSE published Dito CME’s notice stating it would postpone the offer due to “less than ideal” market conditions and that the firm would refund those who had already paid for shares. The PSE imposed a trading halt on Dito CME on Jan. 31 in order to get clarification from the company.

It was lifted on Feb. 2 after the company provided additional information, including the schedule for the refund of payments already made. However, the PSE added: “Please note that this should not be construed as an approval by the exchange of the deferment of the offering.”

Market analysts said a troubling sign for investors was the failure of Uy’s flagship Udenna Corp., Dito CME’s parent firm, to step in and save the deal. In the prospectus on the rights offering, Udenna had pledged to China Bank Capital Corp., which solely handled the fund-raising exercise, that it would take up all the offer shares that wouldn’t be bought “to ensure the offer shares are fully subscribed.”

But this it did not, and one reason could be that Udenna has already become very highly leveraged — it had much more debt than equity. Udenna’s assets range from energy, logistics, telecommunications, property, infrastructure to restaurants. It undertook an aggressive debt-fueled acquisition binge during this administration, getting the label “Duterte crony” from the President’s critics.

Nikkei Asia recently reported that Udenna’s assets jumped to P310 billion in 2020 from just P31 billion in 2015. But during the same period, debts swelled to P255 billion from only P22 billion. According to Nikkei Asia, Udenna’s losses in 2020 worsened to P8.6 billion from P3.3 billion in 2019 as it was similarly hit by the COVID-19 pandemic.

Monzon expressed to the Inquirer his concerns about the cancellation of the stock rights offering, which is a type of fundraising wherein a company sells new shares to existing stockholders. A first in recent PSE memory, he pointed out that a number of minority stockholders likely incurred an “actual loss” if they sold Dito CME shares when the price was adjusted lower after the Dec. 20, 2021, ex-rights date (the first day when new buyers of Dito CME stocks on the bourse are no longer entitled to join the rights offering).

“This is not a theoretical loss. There is an actual loss to investors who sold after the ex-rights date because they have sold at a lower price,” Monzon explained. He said the PSE already received several complaints during the weekend when the news went public.

Monzon added that if this is allowed to happen again, “it’s going to make a mockery of this ‘firm underwriting’ concept.” A standard feature in PSE fundraising documents, firm underwriting refers to the underwriter’s commitment to buy the shares that are unsubscribed after the offering period. This is meant to protect investors because the underwriter will ensure the offer is successful. In Dito CME’s prospectus, Sy-owned China Bank Capital stated it would firmly underwrite the rights offer and buy the unsubscribed rights shares pursuant to its firm underwriting commitment. “That is exactly the role of the underwriter,” said Monzon.

Monzon conceded there was little the PSE could do to prevent Dito CME from scuttling the deal and that affected investors could just lodge complaints before the Securities and Exchange Commission. Still, it is incumbent upon the bourse to decide on this matter with the goal of protecting small investors.

As COL Financial Group Inc. president and chief executive Conrado F. Bate said: “We trust that our regulators will handle this development with the protection of those investors in mind, especially since there is a large number of minority shareholders that participated in the offering.”

At the same time, imposing sanctions on those who may have violated the exchange’s rules and regulations will also help prevent a repeat of this unfortunate incident. As the PSE itself pointed out in the case of Dito CME: “The company, its underwriter, and other advisers are responsible for strict compliance with the rules of the exchange.”

READ: PSE: Dito minority investors to be hurt by cancellation of P8 billion rights offer