The moratorium imposed by the Bangko Sentral ng Pilipinas (BSP) on any increase in online bank fund transfer fees comes as a piece of good news to start the new year for many consumers, who have been forced to go digital by the pandemic and enjoy the convenience such digital payment schemes offer — but at a steep price.

The policy-making Monetary Board of the BSP approved last Dec. 23 the freezing of any hike in InstaPay and PESONet fees for person-to-person fund transfers in a bid to entice more people to adopt the technology and speed up the Philippines’ transition to a more cash-free economy. The memorandum was signed by BSP Governor Benjamin E. Diokno on Dec. 28.

PESONet, a digital fund transfer scheme, is considered as an electronic alternative to the check system. It allows for bigger transactions beyond P50,000 and is credited to the receiver by the end of a banking day. InstaPay, on the other hand, is its retail counterpart and is convenient for e-commerce and other urgent consumer payment needs as it allows for real-time transfer of funds up to P50,000.

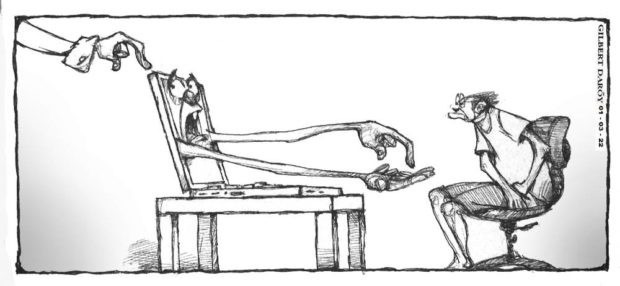

However, the cost of going digital is getting burdensome for many consumers. Every transaction, even for a few hundred pesos, is charged a fee if one is dealing with different institutions. The convenience offered by the ubiquitous automated teller machines (ATMs) has become costly as well, particularly to ordinary depositors getting money from an ATM of another bank.

As consumers do more of their necessary household tasks such as paying for water and electricity bills, buying groceries, and purchasing other daily needs through the convenience of the internet, it is incumbent on regulators to be responsive to the needs of a public already suffering from the economic impact of the COVID-19 crisis. Big financial institutions and companies offering e-wallet services have been making billions of pesos in net profit even during the health crisis, while people have had no choice but to pay up for the online transactions given mobility restrictions.

The BSP should scrutinize and regulate more strictly the fees charged on digital transactions—from bank fund transfers to e-wallets such as the GCash and Paymaya mobile apps, and even the ATM network—with their potential impact on the majority of ordinary consumers needing to pay for essential utilities and goods they cannot live without. Why, for instance, should a person sending P500 or less to an online merchant for food purchases be charged about P15 (for GCash bank transfer) to P25 (for InstaPay) in transaction fee? The volume of deals being done each day hints at the massive amount accruing to the banks and e-wallet operators. In November 2021, for instance, the BSP said there were 42.82 million InstaPay transactions worth P270.2 billion. At a fee of P25 per transaction, the amount collected by banks amounted to P1.07 billion. The banks’ defense is that such transactions entail cost to them. But how much do they really cost? Is P25 for every single InstaPay transaction or P15 for a GCash transfer justified?

Depositors who have entrusted their savings that earn very little, and that are then extended by banks as loans to corporate and other borrowers at much higher interest rates, have every right to grumble at these stiff fees, and to suspect that financial institutions see these digital payment schemes as another revenue source.

Diokno said the lifting of the moratorium on InstaPay and PESONet fee increase would be reviewed by monetary authorities “upon issuance of pricing standard/guidelines or once the volume of digital payments reaches 40 percent of the total retail payments in the country, whichever is earlier.” Perhaps the BSP can make the freeze on these fees permanent and in fact mandate the lowering of fees once the volume of digital payments has reached its target. The BSP can also look at the freeze order it imposed on new players in digital banking by allowing more seasoned players—both local and foreign—to come in and provide more options to the public. This should enhance competition and result in improving and expanding services and lowering transaction fees.

At the start of the pandemic, many financial institutions waived their InstaPay and PESONet transfer fees as a relief measure for consumers battered by the economic downturn. The BSP then extended the waiver of fees for fund transfers until the end of last year. Now that the fees have been reimposed, the BSP may want to look into easing the burden imposed on the public by these fees, either by forcing a reduction or allowing more players willing to offer much lower rates than what people are being charged today.