Certification on non-payment of fines

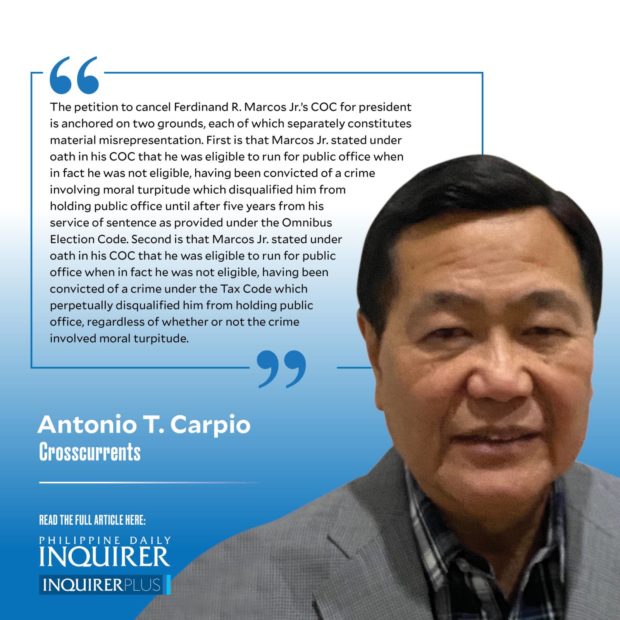

The petition to cancel Ferdinand R. Marcos Jr.’s certificate of candidacy (COC) for President is anchored on two grounds, each of which separately constitutes material misrepresentation. First is that Marcos Jr. stated under oath in his COC that he was eligible to run for public office when in fact he was not eligible, having been convicted of a crime involving moral turpitude which disqualified him from holding public office until after five years from his service of sentence as provided under the Omnibus Election Code. Second is that Marcos Jr. stated under oath in his COC that he was eligible to run for public office when in fact he was not eligible, having been convicted of a crime under the Tax Code which perpetually disqualified him from holding public office, regardless of whether or not the crime involved moral turpitude.

Last Dec. 13, 2021, the Second Division of the Commission on Elections (Comelec) issued an Order denying all interventions in the proceedings to cancel Marcos Jr.’s COC, and directing the petitioners and Marcos Jr. to submit their respective Memoranda within five days, after which period the case is deemed submitted for resolution. Under Comelec rules, the proceedings to cancel COCs are “summary in nature.” Thus, the Second Division will decide the case only on the basis of the Petition, the Answer, the Memoranda, and whatever documents the parties may have submitted as of the last day for the submission of the Memoranda.

One crucial document for consideration of the Second Division is the Certification dated Dec. 2, 2021 issued by Rowena Sto. Tomas-Bacud, the Officer-in-Charge of Branch 105 of the Quezon City Regional Trial Court that convicted Marcos Jr. for tax evasion and non-filing of income tax returns. The Certification states that “there is no record on file of: (1) Compliance of payment or satisfaction of the Decision of the Regional Trial Court dated July 27, 1995 or the Court of Appeals dated October 31, 1997; (2) Entry in the Criminal Docket of the RTC Decision dated July 27, 1995 as affirmed/modified by the Court of Appeals’ Decision.”

This Certification is binding on the Second Division, unless Marcos Jr. can show either proof of payment of the amounts he was ordered to pay in the Court of Appeals Decision of Oct. 31, 1997, or that the Certification was not issued by the proper court official. Before any payment could have been made by Marcos Jr., there must have been an Order of Payment issued by RTC Branch 105 for the payment of the deficiency income taxes, fines, and surcharges. Otherwise, the Bureau of Internal Revenue would have no basis in accepting payment of the deficiency income taxes and the interests thereon. Neither would the Clerk of Court have basis in accepting payment of the fines and surcharges.

Marcos Jr. could not possibly question the authority of Rowena Sto. Tomas-Bacud in issuing the Certification. As the Officer-in-Charge of Branch 105, she exercises “supervision and control” over the Branch Clerk of Court pursuant to the Manual for Clerks of Court. Under the Manual, the “Branch Clerk of Court xxx keeps the following books: xxx General Docket, xxx Judgment Book xxx, Book of Entries of Judgment, xxx Execution Book.” Moreover, under Rule 39 of the Rules of Court, the Branch Clerk of Court makes the entries on the Docket Book and Execution Book whenever there is full satisfaction of judgment. Likewise, fines and surcharges due the State in satisfaction of judgments in criminal cases are paid to the Branch Clerk of Court, and recently, to the Landbank upon instruction of the Branch Clerk. A manifestation of satisfaction of judgment is required to be filed with the Branch where the case is filed whenever a voluntary payment is made to the judgment creditor. Clearly, there can be no ground to question the Certification issued by Judge Rowena Sto. Tomas-Bacud.

The Answer of Marcos Jr. to the Petition did not deny specifically the material averments relating to his disqualification under the Tax Code. Thus, the material averments are deemed admitted. Moreover, the disqualification under the Tax Code is “perpetual” and cannot be removed by the service of sentence or the payment of the deficiency income taxes, fines, and surcharges. Only a presidential pardon can remove the perpetual disqualification under the Tax Code.