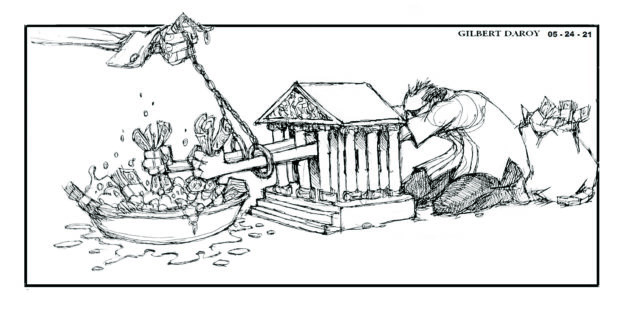

‘Medium’ risk for money laundering

Money laundering remains a serious threat to the Philippines, which has had its share of embarrassing incidents in the past such as the Bangladesh central bank heist where $81 million in stolen money vanished in local casinos in 2016.

One sector that is particularly vulnerable to cybercriminals is the local capital market. According to an assessment report released last week by the Securities and Exchange Commission (SEC), the capital market is at “medium” risk of being exploited for money laundering, especially as the rise of digitalization has made it easier for criminals to avoid detection and conceal their financial pipeline.

Article continues after this advertisementThis was reflected in the 774 suspicious transaction reports involving P11.5 billion received by the Anti-Money Laundering Council (AMLC) from 2017 to 2019. The majority of the transactions were suspected to have been made for the commission of crimes here, while five transactions were believed to have been committed in China. Among the so-called predicate crimes mentioned in the SEC report are plunder, graft and corruption practices, drug trafficking, as well as fraudulent practices and violations of the Securities Regulation Code, which govern the capital market. Predicate crimes are components of larger crimes such as racketeering, terrorist financing, and money laundering.

The rating was based on the 2021 Sectoral Risk Assessment for the Securities Sector conducted by the SEC with technical assistance from the Asian Development Bank. It covered all of the 304 stockbrokers and dealers, investment houses, securities underwriters, financing companies, government securities dealers, investment company advisers, and mutual fund distributors supervised by the SEC.

While the assessment found “extremely low or nil” risk as far as terrorist financing was concerned, the SEC noted that the sector attracted various criminal threats with moderate levels of sophisticated tactics and methods to commit offenses linked to money laundering. “The cheap availability of internet access, increasing functionality of mobile phones, and technological advancements that speed up transactions have provided criminals with tools to escape detection or to hide the proceeds of their illegal activities,” the SEC pointed out.

Article continues after this advertisementIt also noted a significant number of factors that make the sector prone to criminal misuse. For instance, stockbrokers and dealers have to deal with billions of pesos daily and the speed of the trades makes the stock market vulnerable to money laundering. It also said that the involvement of law firms in the suspicious transaction reports filed by investment houses and underwriters of securities indicated the vulnerability of this sub-sector to crimes that may be committed by such entities.

The specter of the presence of money laundering in the market carries major consequences—reputational damage, loss of public trust, costs relating to regaining customer confidence, increased compliance requirements, and heightened regulatory action for individuals and the capital market.

The potential damage to the country is far more serious. The economy may see adverse impacts on the integrity and standing of the Philippine financial market, and the country may end up attracting foreign criminals in need of a safe haven for the proceeds of their illegal activities.

The SEC has promised to develop regular reporting mechanisms and processes to collect adequate, accurate, and up-to-date information from individuals in the securities sector. It also vowed to take steps to conduct regular offsite and onsite inspections of entities under its supervision. It said it would issue specific guidance to the securities sector to develop an understanding of major crime threats and vulnerabilities, and conduct more seminars, workshops, and conferences on this critical area.

Protecting the country against online syndicates will require more than such vigilance. The government and the private sector need to invest in the latest technology and update their systems regularly to thwart the evolving techniques and methods used in cybercrimes and money laundering operations. Prevention, as they say, is always better — because much less costly — than cure.