Competitiveness of PH, cities

Philippine competitiveness has improved significantly in a number of areas over the past few years. The country is particularly competitive in its position in the global supply chain vis-à-vis the electronics industry and locators in export zones.

Another area of competitiveness is the exponential growth over the past 10 years of our information technology/business process outsourcing sector where we are now either No. 1 or No. 2 in the world depending on the service being provided.

We have dropped practically all our import tariffs to zero but still our small and medium enterprises have shown their resiliency not only by surviving but also by thriving.

Asean integration

The economic integration of the Association of Southeast Asian Nations (Asean) is an opportunity to expand the market for Philippine products and services from 100 million Filipinos to 600 million Asean nationals.

The regional integration is also an opportunity to give Filipino consumers the best products and services that Asean has to offer and provide.

In the wake of the integration, there is a need for all areas where the country is competitive to be supported, expanded and institutionalized. Thus, the National Competitiveness Council (NCC) was born out of the desire of the government and business sector to jointly address and build up the long-term competitiveness of the Philippines, and help reduce poverty through inclusive growth in a public-private partnership (PPP) approach and work program.

The program calls for NCC to:

- Benchmark against key global competitiveness indices.

- Map each indicator to the agency responsible.

- Focus on lowest-ranking indicators.

- Track city competitiveness and key indicators.

- Concentrate (working groups) on specific projects.

- Link work to the Philippine Development Plan, national budget, Legislative Executive Development Advisory Council and Cabinet agenda.

12 global reports

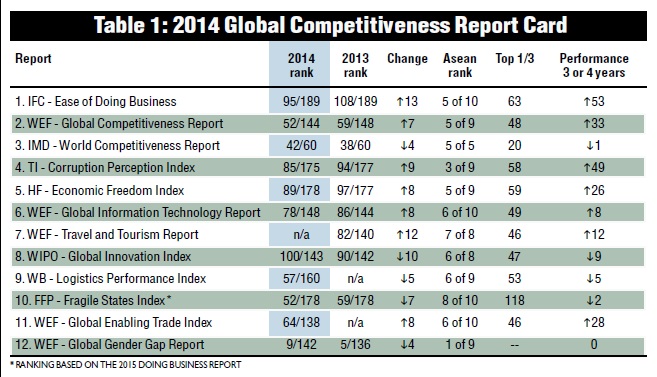

NCC uses 12 global reports to measure competitiveness as shown in the 2014 Global Competitiveness Report Card. (See Table 1.) We have improved in 9 of the 12 reports, particularly in the World Bank and International Finance Corp.’s Ease of Doing Business (up 53 notches), World Economic Forum (up 33 notches), and Transparency International’s Corruption Perception Index (up 49 notches).

The primary reason for the significant improvements in Philippine competitiveness rankings is stakeholder engagement, and awareness of global best practices and policy improvement processes to increase productivity and efficiency.

Game plans

To do so, NCC developed game plans (we are now in game plan No. 3) that serve as road maps for improvements. These were developed and implemented using a public-private sector approach, with national government agencies (22), local government units [LGUs] (535), individual Filipinos and foreigners as well as business entities and chambers (150), bilateral and multilateral development agencies (15) and nongovernment organizations in and outside the Philippines.

Business permits, licenses

Two examples of such improvements are in the Business Permits and Licensing Systems (BPLS) and Balance Scorecards: Local Government Units on the Governance Pathway.

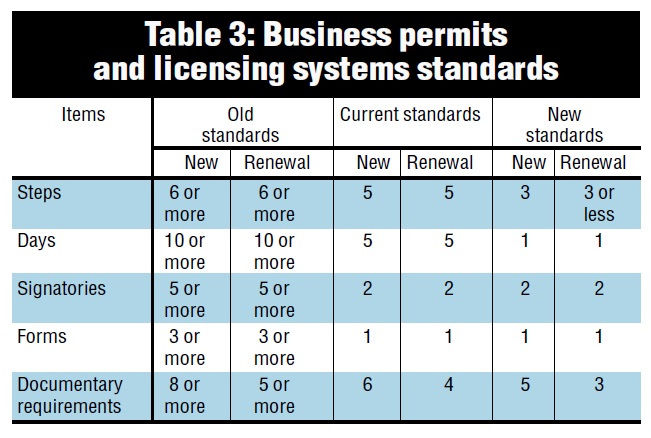

In 2014, 137 cities (out of 144) and 1,152 municipalities (out of 1,490) were streamlined.

The effects of the streamlining are shown in BPLS standards (old, current and new) where there are improvements in terms of the number of steps (three or less from six or more), number of days (three or less from 10 or more), number of signatories (two from five or more), number of forms (one from three or more) and documentary requirements (five for new vs eight or more; and three for renewal vs five or more). [See Table 3.]

The “2014 Global Competitiveness Reports Philippines and Asean” shows our ratings in the middle except in logistics and innovation where we need to focus much-needed improvement. The Failed States Index is a continuous challenge as it is driven by internally displaced persons and disasters (natural and man-made).

Economic freedom

The latest report NCC has received is the 2015 Index of Economic Freedom. It measures a nation’s commitment to free enterprise and where the Philippines is ranked the fifth most-improved economy. Economic freedom is important in attracting foreign investors as it signals that the country welcomes such types of investors. In the Asean, the Philippines charted an upward trajectory with a total gain of 39 places from 115 in 2011 to 76 in 2015, making the country the most-improved Asean economy.

NCC has brought competitiveness from the global and national level to the regional and local arena by organizing regional competitiveness committees (RCCs) in 15 regions plus Metro Manila. The council is tasked with tracking competitiveness indicators to enable RCCs to create better strategic plans for the region(s) while providing options for investors to locate and for Filipinos to choose where to live and work.

Diagnostic tool for LGUs

RCCs serve as a building block for overall competitiveness as they help in the conduct and implementation of, among other things, the Cities and Municipalities Competitiveness Index (CMCI).

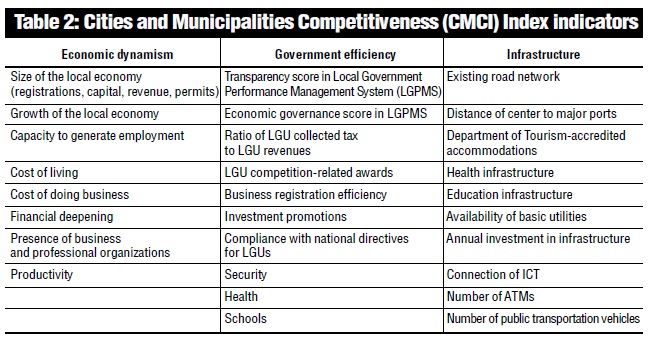

Similar to the Global Competitiveness Reports, CMCI serves as a diagnostic tool for local governments to see how they measure up with a broad range of activities and sectors in economic dynamism (size and growth of the local economy, and capacity to generate employment), government efficiency (economic governance score in the Local Governance Performance Management System and security) and infrastructure (existing road network and health infrastructure) as shown in the table on CMCI indicators (See Table 2.)

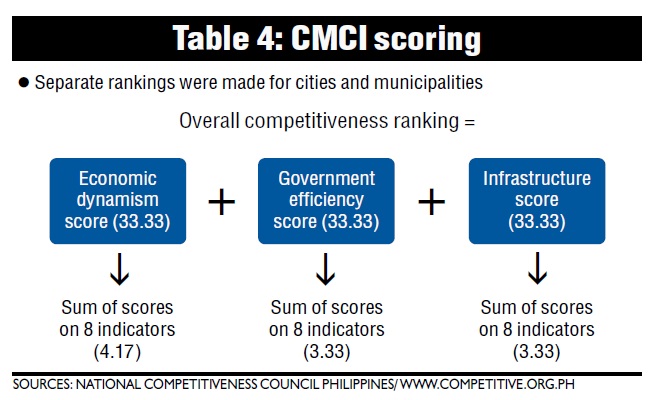

CMCI scoring is the sum of the factors under economic dynamism, government efficiency and infrastructure with separate rankings made for cities and municipalities. (See Table 4.)

Out of 1,634 cities and municipalities in the Philippines, CMCI covered 285 LGUs in 2013 and 535 in 2014.

Top cities, municipalities

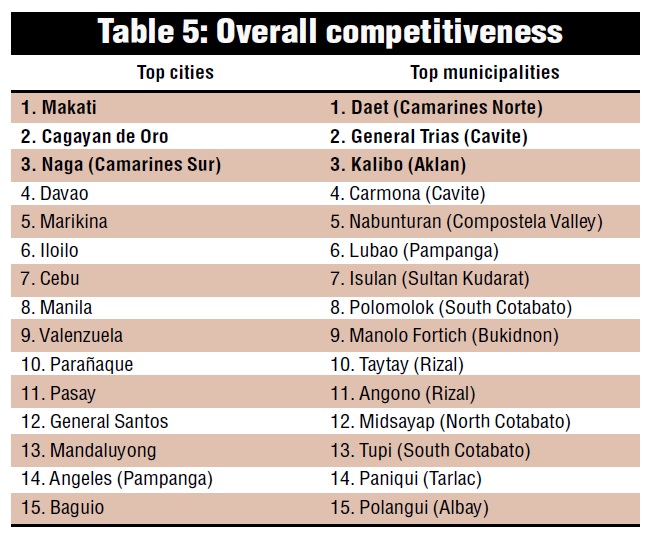

In terms of overall competitiveness, the top three cities were Makati, Cagayan de Oro and Naga. For municipalities, the top three were Daet, General Trias and Kalibo.

The overall competitiveness also includes the Top 15 cities, such as General Santos and Baguio, and the Top 15 municipalities, like Isulan (Sultan Kudarat), Tupi (South Cotobato) and Polangui (Albay).

Some business insights

It is gratifying to note that there are many LGUs outside Metro Manila, and Central and Southern Luzon that are competitive in terms of economic dynamism, government efficiency and infrastructure.

What are some of the business insights learned over the past years in road shows, meetings and conferences both domestically and internationally?

- Change in mindset

First, we have to change our mindset from a 20th-century framework to that of the 21st century. The 20th-century mindset is protectionist, isolationist, scorched-earth approach to business (as much as possible, a monopoly or, at the most, an oligopoly), outdated competition policies and laws with little or no strategic policy and little or no continuity in vision and policies.

A 21st-century mindset considers that we are in a globalized world and part of the global supply chain where the Philippines and the Filipino entrepreneur and business enterprise must find its niche in the supply chain considering our human and natural resources plus geographical location.

We must consider and maximize the provisions of the trade agreements and community that we are part of—the Asean Economic Community, World Trade Organization, Japan-Philippines Economic Partnership Agreement and possible new agreements such as the Asean-Hong Kong Trade Agreement. Also, the Philippines needs to decide whether we should join discussions on the Trans-Pacific Partnership.

- Public-private partnership approach

The approach should be a public-private sector approach where the public sector provides enabling policies, regulations and processes at the national, and most importantly, at the local level as the city or municipality is the government entity that has immediate interaction with and impact on the citizens. On the other hand, the private sector focuses on operations and its core competencies, its business and its role in the community.

- Think big, operate small

The challenge is to think big, operate small—think big for the mission and vision, and small to implement the daily and annual activities to achieve the vision for the city, municipality, the national government agency, the government-owned or controlled corporation (GOCC) and the private enterprise.

Furthermore, if a company, government agency, GOCC or LGU cannot handle efficiently small things, like vandalized walls and jaywalking, how can it handle big things? Other examples are the postal services and the need for timely delivery of mail; the airports that should have as many seats as passengers for a given flight. Such basic and self-evident solutions are small details that are easy to address.

(Ruy Moreno is director for operations [private sector] of the National Competitiveness Council.)

RELATED STORIES

Local competitiveness: measurement and management

PH jumps 7 notches in WEF rankings